Brazil Electricity Liberalization Market Size: The $200B Opportunity Explained

- Marcellus Louroza

- Aug 10, 2025

- 3 min read

European investors keep asking about the real scale of Brazil’s power reform. Today about 39% of national demand already buys in the free market (ACL), represented by 69,000+ consumer units—mostly large industrial and commercial players managed under the rules of ANEEL, the market chamber CCEE, and the system operator ONS.

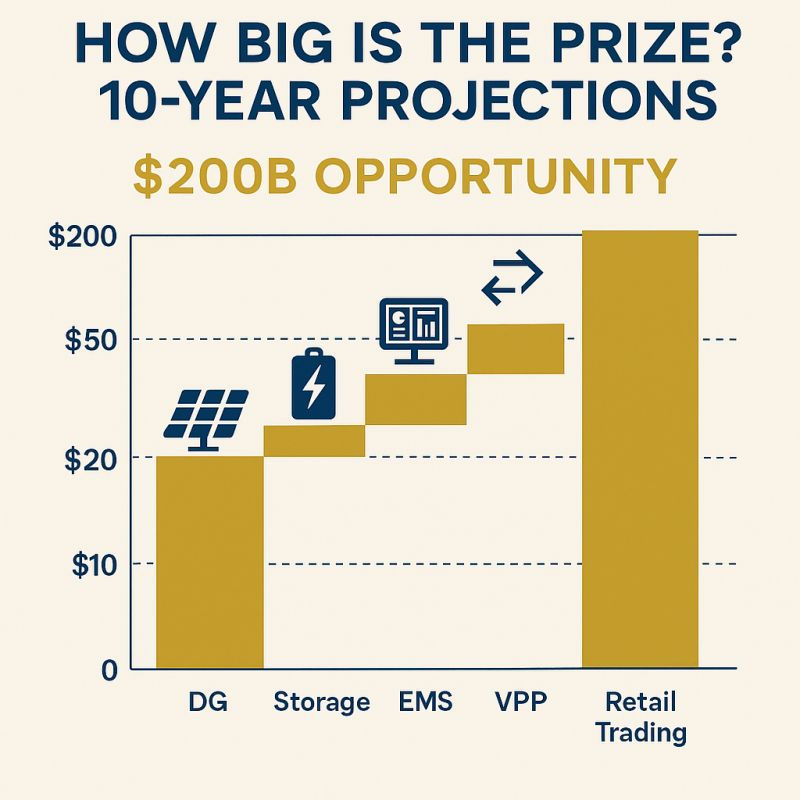

By 2030, liberalization could open supplier choice to all 89 million consumers, creating the largest retail electricity arena in Latin America. To anchor expectations, here is a segment-by-segment view of the brazil electricity liberalization market size over the next decade.

Distributed Generation (DG). Residential and small-business solar is expanding at roughly 3–5 GW per year, with residential PV growing near 60% year over year per trade trackers like ABSOLAR. Assuming a blended installed cost of US$0.9–1.2/W over the decade, DG alone could attract US$25–40B in cumulative capex. Add inverters and smart controls from platforms such as Fronius, SolarEdge, and SMA Solar, and you build the device base for automation and trading.

Energy Storage. Global learning curves—tracked by sources such as the IEA and analysts like BloombergNEF—point to 40–50% battery price declines by 2030. With PV saturation and dynamic tariffs, Brazilian households could surpass 3 million residential batteries by the early 2030s. Even at a conservative US$2,000–3,000 per unit average over time, that’s US$6–9B in hardware revenue, plus installation and service layers.

Energy Management Systems (EMS). As meters digitize and tariffs become time-based, EMS turns price signals into automation: EV charging, water heating, HVAC, and appliance scheduling. If 10–15% of households adopt EMS by 2035 (starting from low single digits), service revenues of US$80–150 per home per year imply multi-billion recurring income for retailers and tech firms. Providers with proven stacks—tado°, Hive, Loxone, Schneider Electric, ABB—can localize quickly.

Virtual Power Plants (VPP). Globally, VPPs are compounding at ~21.6% CAGR. Brazil’s flexible capacity—EVs, batteries, controllable loads—could aggregate to 5 GW by 2035, with earlier milestones near 2–3 GW as retailers and aggregators monetize peak shaving, frequency response, and capacity services. With market mechanisms evolving at CCEE, VPPs become the software monetization layer on top of DG and storage.

Dynamic Tariffs and Retail Trading. Once all 89 million users gain supplier choice, switching to time-of-use or dynamic pricing could hit 15–25% within five years. Retail trading platforms that bundle devices, tariffs, and financing will capture the lion’s share of customer lifetime value. European models such as aWATTar show how hourly prices plus automation unlock 5–15% bill reductions for households while increasing retailer margins via flexibility revenues.

Pulling it together. In Europe, these same segments generated billions in recurring revenue for EMS vendors, aggregators, and traders. In Brazil, the combined prize—DG capex, storage rollouts, EMS subscriptions, VPP services, and retail trading margins—can exceed US$200B in cumulative investments and revenues over the next decade, provided three conditions align:

• Regulation: transparent network charges, standardized switching, and certified data access so consumers can share metering data with retailers and fintechs.•

Technology: interoperable standards (DLMS/COSEM, OpenADR, OCPP) and utility IT upgrades to enable near-real-time settlement and flexibility markets.•

Consumer engagement: app-first onboarding, default-on automation, and monthly reports showing reais saved, kWh shifted, and CO2 avoided.

Actionable milestones to watch:• Smart meter rollout pace and data-sharing rules from ANEEL• Retail access schedule published by CCEE and legislative updates• Pilot KPIs: MW of flexible load enrolled, switching rates, and verified household savings• Capital formation: project finance for DG and storage, plus growth equity for EMS/VPP platforms.

Brazil electricity liberalization market size as a decade-long growth flywheel

As devices proliferate, automation raises savings and satisfaction; higher value attracts more entrants and capital; competition delivers better tariffs and services—spinning a flywheel that compounds for consumers, retailers, and the grid.

Comments